Jonathan Higginson | VP, US Access Strategy

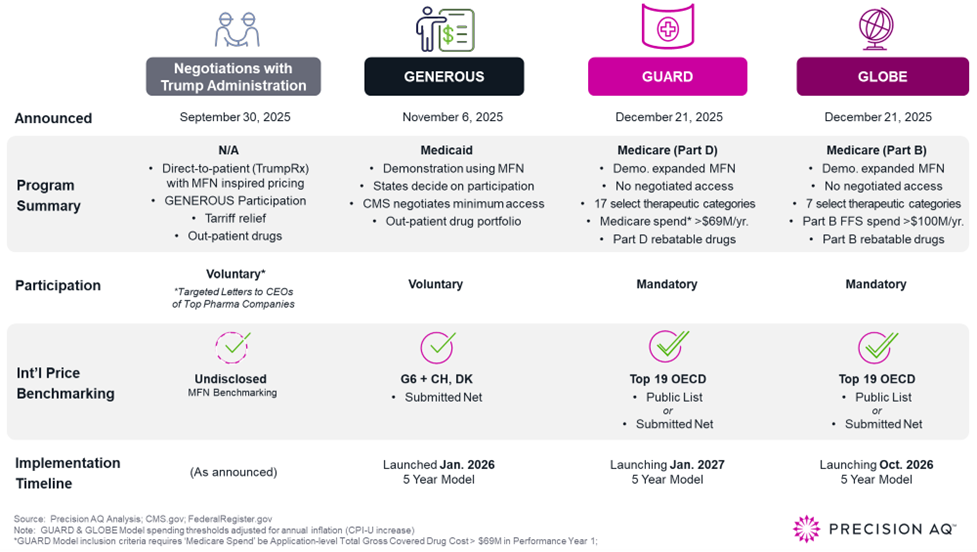

The introduction of the GUARD and GLOBE Models, following the GENEROUS Model and major pharmaceutical negotiations with the Trump Administration, marks a significant inflection point for the future of drug pricing. These policies constitute an aggressive yet foreshadowed shift in tethering U.S. government prices to MFN, moving from policy debate to operational reality. As implementation approaches, pricing and access leaders should recognize that the landscape for pricing, launch sequencing, and long-range planning is fundamentally changing.

GUARD and GLOBE are CMS’s most assertive steps to date to reduce Medicare drug costs by referencing international price benchmarks. While pilot programs face legal challenges to implementation, both are mandatory models and will target samples representing ~25% of Medicare lives.

As pilot programs, both target single-source drugs and biologics within specified high-spend therapeutic categories: GUARD (Guarding U.S. Medicare Against Rising Drug Costs) targets drugs and biologics eligible for reimbursement under Part D, and GLOBE (Global Benchmark for Efficient Drug Pricing) targets those under Part B.

The core mechanism for both is an MFN-driven alternative calculation of an additional incremental manufacturer rebate (if applicable for a revised total rebate) under the Medicare Inflation Rebate Program - if U.S. net prices (i.e., performance year Medicare net price / ASP) exceed the select model MFN price benchmark from the international reference basket of 19 ‘economically similar’ countries. Together, these models reduce Medicare net pricing and mark a change in overall U.S. gross-to-net dynamics.

These models fundamentally alter the longstanding isolation of U.S. pricing and seek to address the disparity between U.S. and ex-U.S. pricing.

Understanding the GUARD and GLOBE Models

Blockbuster biologics and specialty drugs are most exposed under both models with oncology, immunology, and high-growth categories in the crosshairs.

Expanding from the Medicaid GENEROUS Model with 8 reference markets and focusing solely on net pricing (reported country-level average), the Medicare GUARD and GLOBE Models will look across 19 "economically similar" reference markets.

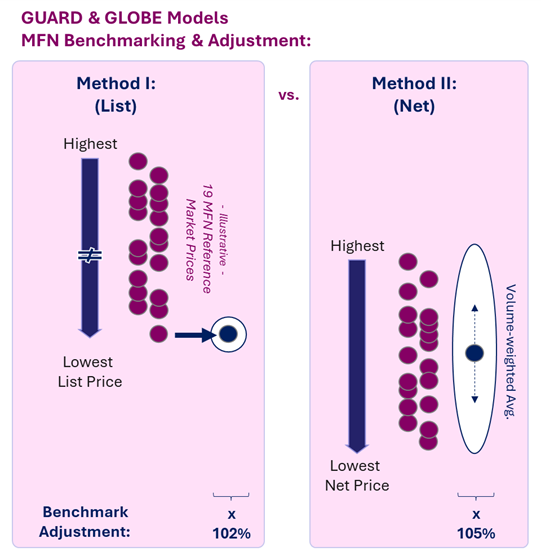

How MFN Benchmarking Works: List Price vs. Net Price

As is, the GUARD and GLOBE Models may be slightly more favorable than the GENEROUS Model, with manufacturers having the choice of referencing to list prices vs. net prices:

- List price, Method I (the default option): Use of existing data from publicly availablepricing databases

- Net price, Method II (the voluntary option): Manufacturer-reported country average, inclusive of confidential discounts and rebates (similar to GENEROUS Model requirement)

While Method I (referencing list prices) is a seemingly more favorable choice for manufacturers, trade-off incentives exist to encourage Method II (referencing net prices). In Method II (voluntarily submitting net price), the MFN benchmark is a volume-weighted average across all markets with a fixed 105% adjustment.

Method I (the default option, which references list prices) benchmarks the lowest country-level price with a fixed 102% adjustment. Both methods also include additional adjustments for country-specific Gross Domestic Product at Purchasing Power Parity (GDP-PPP).

Key Exclusions & Carve-outs

- IRA Maximum Fair Price (MFP): Drugs with an active IRA-negotiated MFP are excluded, creating a moving target for portfolio risk as assets shift between GUARD/GLOBE and IRA coverage.

- Biosimilars and Generics: Biosimilars and generics are excluded; only sole-source/single-source drugs and biologics are in-scope.

- Cell and Gene Therapies: CMS has indicated that cell and gene therapies, especially those with unique administration, limited patient populations, or high up-front costs, as well as plasma-derived products connected with shortage risks, are being considered for exclusion from both models for at least the initial implementation period.

- No Mention of Exclusions for Orphan Drugs: While orphan drugs have previously received protections to ensure incentives for developing new drugs for limited populations with rare diseases, current proposals offer no price protections.

Key Implications for Life Sciences Companies

- Pending Litigation to Challenge GUARD & GLOBE: As mandatory programs (unlike GENEROUS), many companies are reportedly preparing comments and evaluating legal options. While challenges have successfully pushed back the previous Trump Administration's efforts under the International Pricing Index (IPI), significant court rulings and the current adaptation of existing rebate mechanisms make the current efforts more challenging.

- Trump Administration Agreements with Top 16 Pharma/Biotech Companies: While the Trump Administration has associated MFN with agreements across top pharma/biotech companies, CMS has not explicitly exempted these manufacturers from mandatory participation in the GUARD &GLOBE Models if eligible. With agreement details still limited, critical questions persist. Do the 16 companies with negotiated agreements have exemptions from the GUARD and GLOBE models, or other carve-outs or mitigating benefits?

- Model Implementation Timing: Limited windows to adjust MFN reference market pricing remain open with implementation of the GLOBE Model: October 2026, and the GUARD Model: January 2027. Within the current windows, manufacturers can raise ex-U.S. list prices and, potentially, current effective net prices to mitigate future U.S. rebate risks.

- Moving forward, a clear priority will be to establish a minimum list price and refresh global price management policies to mitigate risk from countries at the bottom of the reference basket and prevent basket outliers. Upcoming negotiations and international payer decision-making will be influenced. In the longer term, reactionary policies and operational pricing changes can be expected across MFN reference markets.

- The release of these models and their near-term implementation should be included as ongoing inputs to long-range planning and forecasting.

- ‘MFN Price Benchmarking’ to be fixed to the initial performance year (i.e., ‘as previously calculated’) is the current proposal (for Method I using list pricing); it is a variable subject to significant volatility given regular ex-U.S. price cuts and a detail that should be flagged for any final changes prior to models being implemented.

- Global context: MFN tethering of U.S. government prices to reduce government drug costs is not occurring in isolation - EU HTA convergence, Canada’s PMPRB reforms, Japan’s re-pricing cycles, and China’s VBP are all active efforts tightening ex-U.S. pricing corridors. GUARD and GLOBE amplify these pressures and create novel feedback loops in U.S. pricing that will force a rethink of international discounting, launch sequencing, and the design of value propositions to justify premium pricing.

- Launches and indication expansions with significant Medicare patient populations should assess risks to total global commercial potential, including modeling of intentional delays to protect pricing.

- Launches and indication expansions with significant Medicare patient populations should assess risks to total global commercial potential, including modeling of intentional delays to protect pricing.

- List Price Accuracy & Correction: Those who work in pricing know the many nuances that have plagued international reference pricing. Within the model proposals, there are outstanding questions about what will be required of manufacturers if country-level average list prices are incorrect (under Method I, the default). If the intention is to avoid Method II (submitting net pricing), what options for meaningful correction will be available, or will manufacturers be forced to decide between accepting an incorrect benchmark and an unwilling adoption of Method II, if it provides a higher MFN price benchmark?

- Commercial Insurer Consideration: As with IRA concerns that commercial insurers may reset pricing expectations based on MFP concessions (despite CMS's program confidentiality notes), similar considerations may need to be factored into long-range forecast risks.

- Geographic Randomization: With a quarter of Medicare lives in-scope, revenue risk may be geography-, model-year- (and even traditional Part B/FFS) dependent. Dual-track forecasts (model geographies vs. non-model geographies) may become critical.

What Leaders are Saying About MFN Pricing

2026 JP Morgan Healthcare Conference

Leaders frequently mentioned policy and pricing reforms, highlighting the unprecedented pressure on net pricing, the need for new approaches to US market access, and the importance of scenario planning for both risk mitigation and legal challenge strategies.

Potential for Detrimental Impacts to Rare Disease Drug Development

Given the detrimental impacts on the typically smaller biotechs supporting rare disease development, whose limited portfolios will struggle to balance these impacts, concerns are being raised about the treatment of rare diseases. Even modest uptake can exceed the $69/$100M annual Medicare spend thresholds, and the situation is worse when a high percentage of the patient population has Medicare. As is, historic premium pricing for orphan drug development may be nearing its end.

While recognized and protected from IRA, will smallvoices be enough to bring similar carve-outs for rare diseases to MFN-driven programs? Will advocacy convince CMS that the math of these models doesn’t support innovation for small patient populations with high unmet needs? If so, will CMS provide exclusions, or at least phase in participation, for orphan drugs over time?

Will the Math Mean Pulling Out of Key MFN Reference Markets?

Quiet but rising potential for pulled launches across reference markets is growing, driven by US MFN impacts and rising risk, paired with speculation about the limited willingness of MFN markets to pay higher drug prices. Perhaps the strongest and clearest voice yet is Pfizer’s CEO at JPM: “When we do the math, shall we reduce the U.S. price to France’s level or stop supplying France? We stop supplying France. So they will stay without new medicines. The system will force us to not to be able to accept the lower prices.”

Moving Forward in a Post-MFN World

The GUARD and GLOBE Models are major steps that broaden MFN tethering of U.S. government prices, fundamentally reshaping near-term strategy priorities and, in the longer term, changing established strategies for global commercialization.

The current pre-implementation windows for these models will drive rapid evolution in in-line list and net pricing, with more focused global price management. In addition, greater demands will be placed on the pricing assessments supporting new launches and geographic expansion plans, as well as target pricing strategies for pipeline assets.

The savvy winners are those who are expanding their risk assessments, acting early on scenario planning, and proactively managing both U.S. and ex-U.S. pricing risks.

At Precision AQ, we combine deep payer access expertise with advanced analytics to help you stay ahead in this new, post-MFN world. Whether you are preparing risk assessments, developing or implementing immediate mitigation strategies, or building forward-looking pricing strategies, we are here to support you.

Explore our Value & Access Services to learn more.